Errors and Omissions (E&O) Insurance Cost

You have been in the roofing business for four years now. You made reasonable money, but it all was a little bit harder than you imagined. So, you decide that year four will be your last, and you closed your doors for good. Fast forward three years. There is a knock on your door, and you are served with legal papers.

Mrs. Smith, your client from four years ago, filed an insurance claim on her roof a few years after you installed it, and a professional insurance adjuster came over. They pointed out all the mistakes made in the installation, including adding new shingles over an old layer of shingles. They denied her claim of $10,000.

There were other coverages you were offered, but with the price you were already paying for your Commercial Liability Insurance, you felt that Errors and Omissions Insurance was too expensive and declined the coverage. Now what?

When the evidence is produced, you will lose the case and be forced to pay. If you cannot pay, you are looking at the potential of having your paycheck garnished, or your life savings drained.

Is there any way to avoid this type of financial disaster? The answer is yes, and the policy is called Errors and Omissions Insurance.

How Much Does Errors and Omissions Insurance Cost?

When it comes to trying to determine the cost for Errors and Omissions Insurance, there is no set price for every business. The size of the business is a contributing factor. If the profession is considered risky, then that plays a major factor in the cost of Errors and Omissions Insurance as well.

Other factors contributing to the cost of Errors and Omissions Insurance are:

- E&O claim history,

- Type of business,

- Number of employees,

- Manuals in place, and

- Rates of the insurance company chosen.

However, on average, Errors and Omissions Insurance costs break down like this. If we look at businesses with 10 or fewer employees, the insurance industry average for annual Errors and Omissions Insurance cost is $1,735 per year. While $1,735 is the average price, prices can range from $900 to $2,000. So, it is wise to research different insurance companies.

What Is Errors and Omissions Insurance?

Errors and Omissions Insurance, or Professional Liability Insurance, protects small business owners from:

- Claims of negligence,

- Not performing professional duties, and

- Not explaining to the customer the dangers and risks of the professional advice given.

Who Needs Errors and Omissions Insurance?

In today's litigious society, it is very easy to be sued. It is even easier to be sued if you are in a profession that gives advice or operates on people. The professional services listed below need Errors and Omissions Insurance in their insurance portfolio on day one.

- Doctors

- Lawyers

- Bankers

- Nurses

- Financial Advisors

- Architects

In essence, every business, which offers service or advice for a fee, can be sued. It does not take much for a customer to say that you did not fulfill your professional obligations. The next thing you know, you are in court fighting for your business’ reputation and finances.

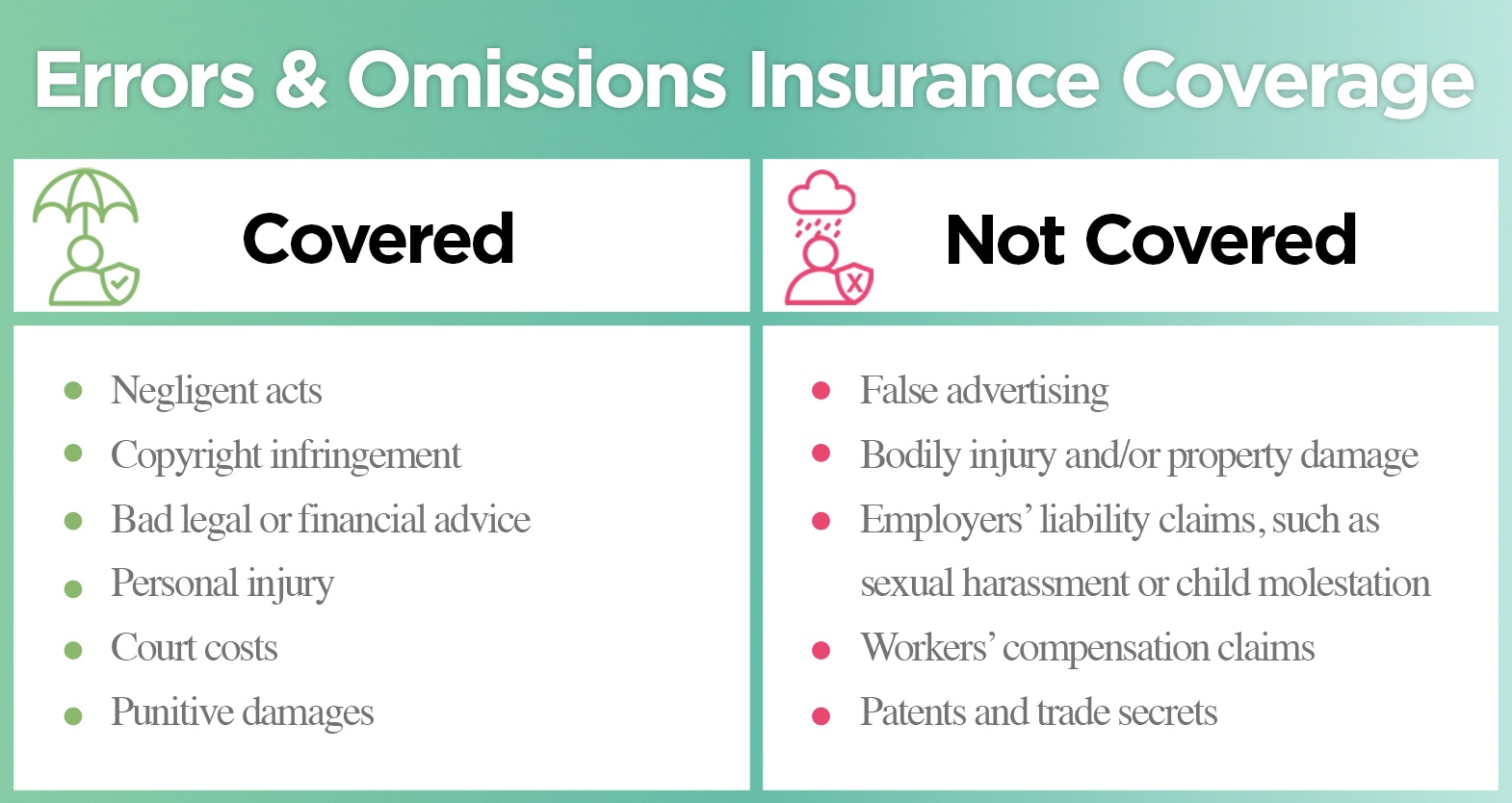

What Does Errors and Omissions Insurance Cover?

Errors and Omissions Insurance is comprehensive insurance coverage. These policies have the ability to protect its policyholders from:

- Negligent acts

- Copyright infringement

- Bad legal or financial advice

- Personal injury

- Court costs

- Punitive damages

Every insurance company offering Errors and Omissions Insurance have their own unique coverage that the next carrier may not offer.

What Does Errors and Omissions Insurance Not Cover?

Items that Errors and Omissions Insurance will not cover:

- False advertising

- Bodily injury and/or property damage

- Employers’ liability claims, such as sexual harassment or child molestation

- Workers’ compensation claims

- Patents and trade secrets

Understanding Limit Options With Your Errors and Omissions Insurance

When you purchase Errors and Omissions Insurance, it is important to understand what you are paying for, and what you are getting in return.

- Occurrence limit – This is the most that your insurance company will pay out to you for any claim made on your policy stemming from one event, regardless of the number of people injured.

- Aggregate limit – This is the most your insurance company will pay in total during the life of the policy.

Like auto insurance limits of $100,000/$300,000, Errors and Omissions Insurance limits are laid out the same way. The typical policy limit will look something like this:

Occurrence/Aggregate – $1,000,000/$2,000,000. It is very easy to understand once you learn what you are looking at.

The medical, architectural, and engineering fields pay the most for their Errors and Omissions Insurance. Why? The reason is when these professionals make a mistake, the results could be catastrophic. In the medical field, if a doctor errs, someone could lose their life. If an architect or engineer makes a mistake, a structure could collapse, causing innocent bystanders to die. With potential catastrophes like these, this should help you understand the pricing behind Errors and Omissions Insurance and the field that you are working in.

$1,735

Prices range from $900 to $2,000 and also vary depending on your zipcode: